WEEKLY SECTOR ROTATION

Brian T. Hannon, CFA

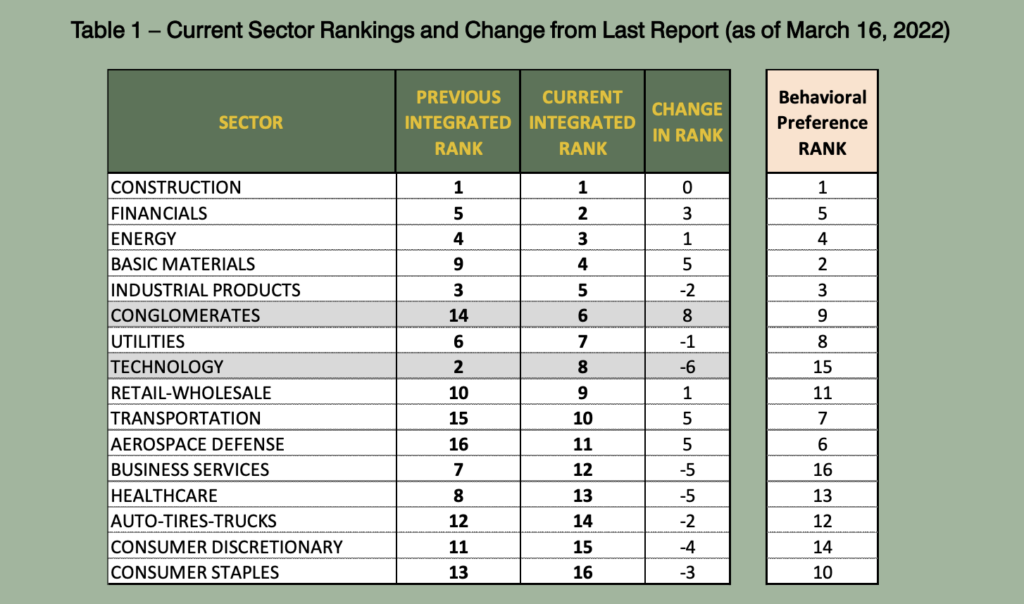

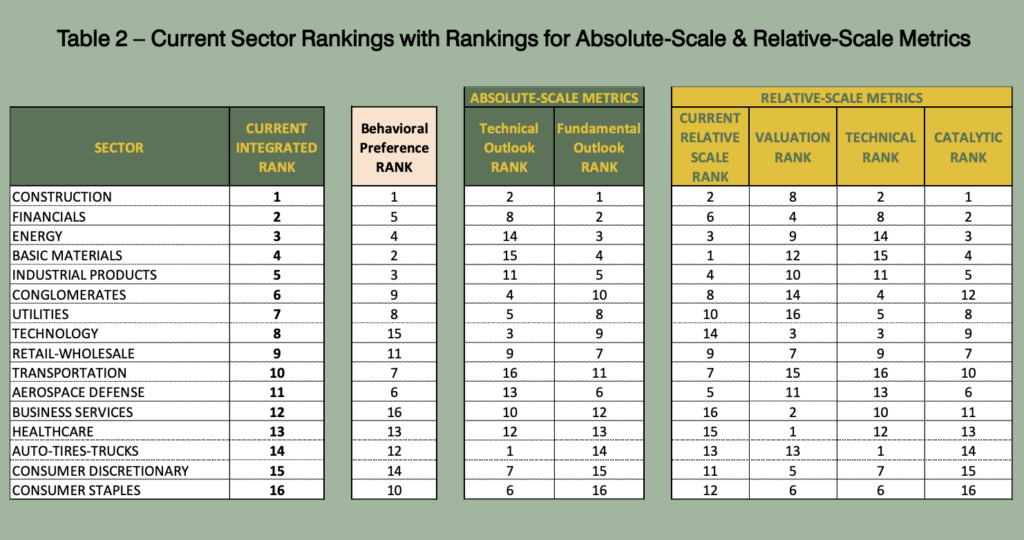

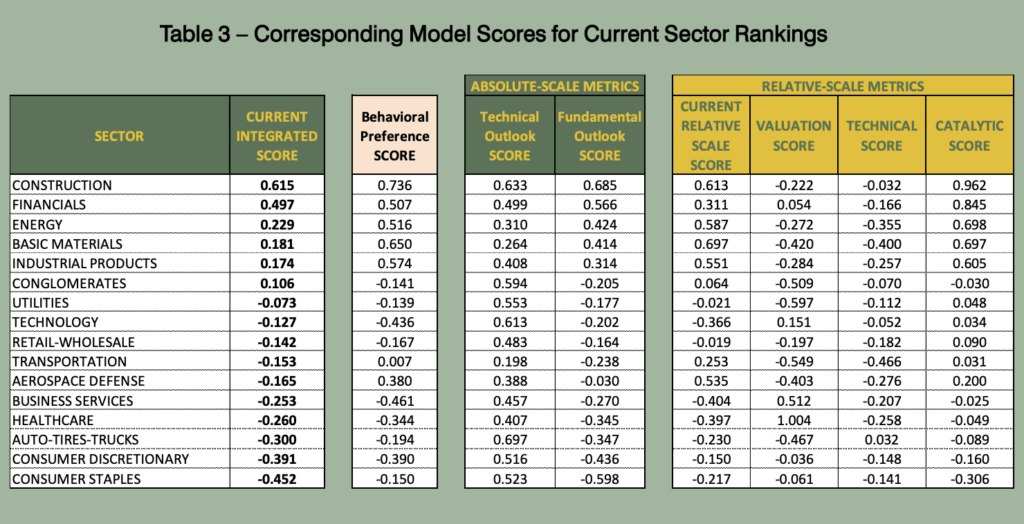

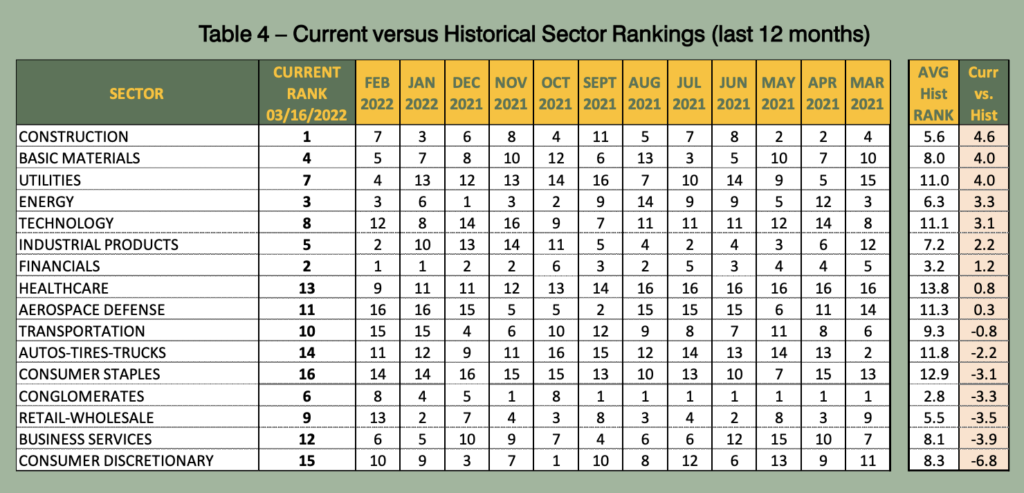

Sector Attractiveness Rankings are Reshuffled as Volatility Continues

Sharp market price volatility has translated into widespread changes in valuation and technical scores

across all the sectors. With few exceptions, changes in our sector attractiveness rankings have been

significant. Notably, the technology and conglomerates sectors retraced their moves from last week.

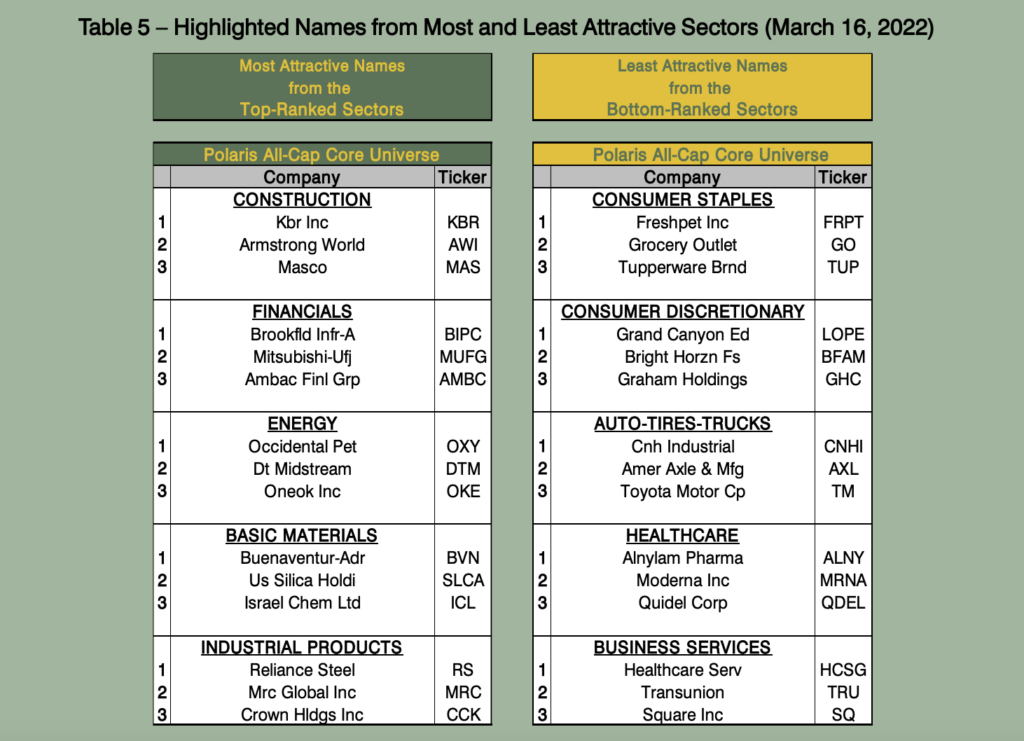

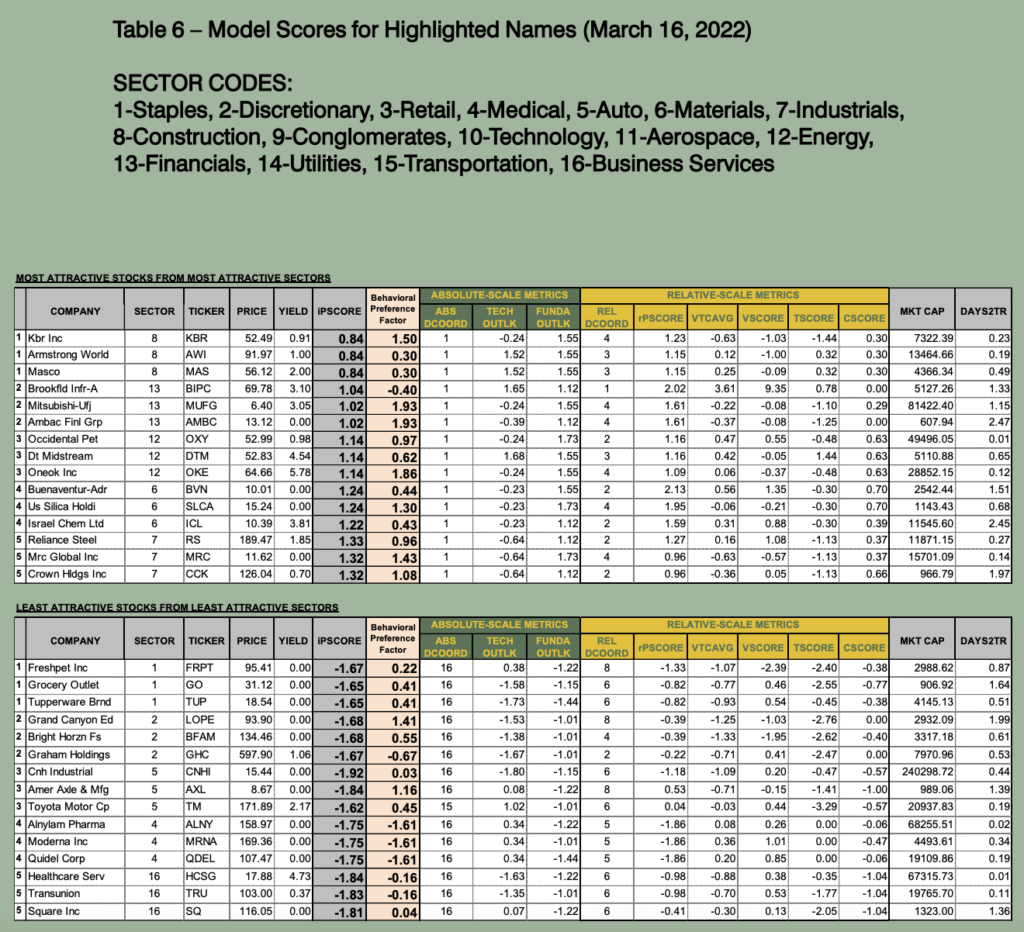

See Tables 5 & 6 where we highlight the most and least attractive names selected from the topranked and bottom-ranked sectors, respectively.

Founder, Director of Quantitative Equity Research

Qubit Research, LLC

Brian Hannon began his career in the chemicals industry at the Dupont Company where he held

various positions in research & development, project management, and corporate finance. While in

R&D, he was awarded a patent for his role in the development of a reverse osmosis application for the

production of semiconductor devices (Patent# 4,879,043: Manufacture of High Purity Hydrogen

Peroxide by Using Reverse Osmosis”).

Brian made the transition to the investment management profession as a research analyst covering

chemicals industry stocks in 1992 at the DuPont Pension Fund. In 1995 he joined ASB Capital

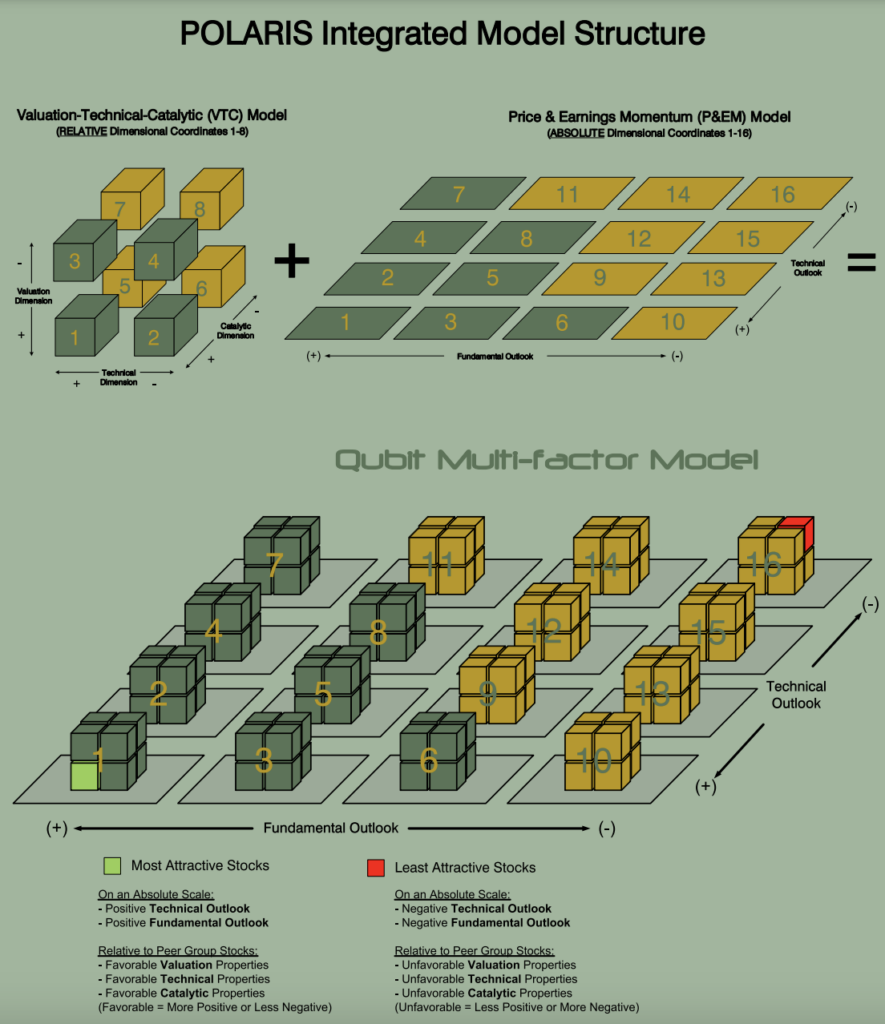

Management where he developed the first version of the multi-factor model that Polaris is based on.

From 1997 to 2006, Brian produced an exceptional track record while serving as a senior portfolio

manager at Macquarie Investments (formerly Delaware Investment Management) on their institutional

large-cap value team. In 2006, Brian founded Qubit Investments, LLC to launch an equity market

neutral fund. He later became the Director of Equity Research at Sturdivant & Co. and then Quoin

Capital, LLC in 2013 and 2020, respectively, which was prior to assuming his current role at Qubit

Research, LLC. Brian holds a BS degree in chemical engineering and a BS in economics from

Carnegie-Mellon University and has been a CFA charter holder since 1991.

DISCLOSURES AND DEFINITIONS

Qubit Research, LLC and its employees, officers, and members may participate as an agent in transactions involving the securities referred to herein (or options or other instruments related thereto), including in transactions which may be contrary to any recommendations contained herein. This publication does not constitute an offer to sell or solicitation to buy of any transaction in any securities referred to herein. Any recommendation contained herein may not be suitable for all investors. Although the information contained in the subject report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This publication and any recommendation contained herein speak only as of the date hereof and are subject to change without notice. Qubit Research, LLC and its employees shall have no obligation to update or amend any information or opinion contained herein. This publication is being furnished to you for informational purposes only and on the condition that it will not form the sole basis for any investment decision.

Each investor must make their own determination of the appropriateness of an investment in any securities referred to herein based on the tax, or other considerations applicable to such investor and its own investment strategy. By virtue of this publication, neither Qubit Research, LLC nor any of its employees shall be responsible for any investment decision. This report may not be reproduced, distributed, or published without the prior consent of Qubit Research, LLC All rights reserved by Qubit Research, LLC This report may discuss numerous securities, some of which may not be qualified for sale in certain states and may therefore not be offered to investors in such states. This document should not be construed as providing investment services.

Investing in non-U.S. securities including ADRs involves significant risks such as fluctuation of exchange rates that may have adverse effects on the value or price of income derived from the security. Securities of some foreign companies may be less liquid and prices more volatile than securities of U.S. companies. Securities of non-U.S. issuers may not be registered with or subject to Securities and Exchange Commission reporting requirements; therefore, information regarding such issuers may be limited.