Christina Surowiec

Putin’s war

2022 opened at an already difficult and inscrutable time for economic prognostications. The complexity and bleak overtones of the task intensified in late February when autocrat Vladimir Putin activated long-suspected plans for a multifront Russian invasion of neighboring Ukraine. Reportage and intelligence disclosures from Western sources correctly appraised the significance of border area troop buildups. But

much pre-attack analysis accorded Putin undue deference in accepting his regime’s reputed military mastery as a given. Massive corruption in Russia’s military and defense ministry was scarcely a secret, though its scale comes as a shock. As the war grinds into a third month, Ukrainian forces have mounted effective counterattacks. The invasion has weakened Putin politically. Putin himself may not have comprehended his armed forces’ manifold deficiencies. The Kremlin is suppressing dissent and even discussion regarding the war, but it cannot obliterate the reality of heavy Russian losses. Putin’s isolation reached an extreme amid the Covid pandemic, facilitating kleptocracy in the top circle and fueling conjecture about Putin’s psychological state.

Russian tactics, including heavy shelling of civilian areas, are credibly condemned as war crimes. A patchwork of sanctions, asset seizures, and withdrawal from Russia by international corporations will adversely affect Russia’s economy and society. Conversely, markets cannot easily wean themselves off Russia’s most valuable product, crude oil, which offsets imposed constrictions to the tune of a billion dollars per day.

People in other conflict-beset parts of the world rightfully bridle at ascribing unique horror to a war taking place in Europe. A more germane distinction might be the starkly national and territorial character of the Ukraine fighting, unencumbered by qualifying nuances (e.g., ethnoreligious or ideological). Two United Nations signatories, who as such uphold sovereignty as a supreme principle, are militarily engaged, with an unambiguous aggressor. But the invader’s veto privilege in the U.N. Security Council effectively strangles international peacemaking attempts.

Witch’s brew: pandemic, food, energy

The Covid-19 pandemic lingers on with somewhat diminished virulence, or at any rate less headline-grabbing capacity. The war and health crisis both cloud prospects for an uncomplicated economic recovery. At this writing, China continues to hold 25 million Shanghai residents under tight lockdown to curb a large outbreak. The situation has rattled equities and prompted doubts whether any government, no matter how authoritarian, can successfully foment a zero Covid policy.

Elsewhere, emphasis has shifted from emergency welfare measures to putting people back to work. However, recurrent staff shortages due to sickness affect enterprises in multiple sectors. Compared to Covid’s earlier ravages, the first and second waves of the Omicron variant show a lower fatality rate (and improved therapeutics help), but a sense of normality is elusive.

Indeed, many aspects of post-Covid normality are nebulous. Key topic areas ripe for creative re-imagining include:

• Health systems

• Supply logistics

• Mismatch of existing facilities with actual

needs and trends – intractable office vacancies,

moribund malls, severe lack of affordable housing

• Digital architecture/regulation – can we

promulgate secure online access for all and at the

same time same time curtail big tech’s monopoly

power and propensity for mass manipulation?

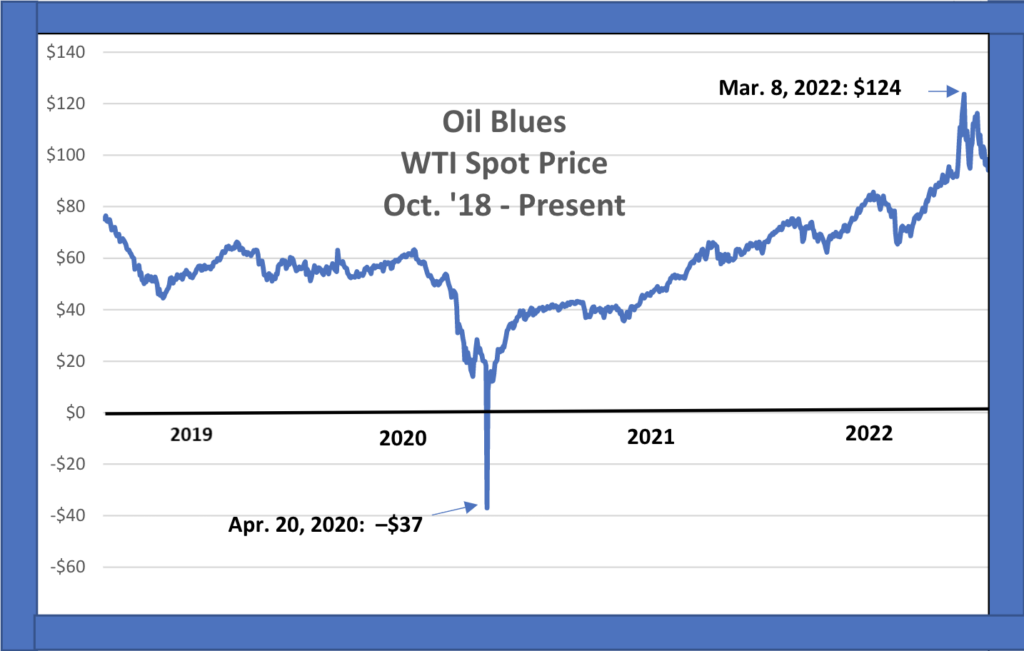

Crazy contortions in oil market: pandemic, then war

Commanding immediate attention, in many categories prices are spiking and availability is sporadic. Similarity with past inflation bouts is limited. As the final section of this report seeks to illumine, factors driving today’s price pressure lack readily assimilable precedent. Standard remedies will not necessarily achieve cookbook results. Mouthed commitments to stop relying on fossil fuels, while scrambling for supply to supplant that of the Russian petro-state, emblematize cognitive dissonance. Calls for boycotts notwithstanding, oil extracted from Russia will be sold and burned, in China and India if less so in Europe. Demand for industrial and transport fuel is only tenuously rebounding from the pandemic, but the war has kicked speculative activity into overdrive. Recall that just over two years ago, spot crude dipped into negative pricing – traders had to pay to deliver it. The Ukraine war is touching off a petroleum bubble. Strategic reserve drawdowns are too small a part of total consumption to dampen prices remarkably. Yet, a financial strategy that counts on intrinsic scarcity as a guarantor of permanently high oil prices could prove reckless. The problem with a carbon-based economy is not short supply but risk of ecological and civilizational collapse if unconstrained anthropogenic emissions remain the norm much longer.

Russia and Ukraine combined provide one-quarter of world grain exports, including half the grain imported by the African continent. The warring parties’ likelihood of approaching that volume this year is low. So the conflict augurs ill for food-insecure regions. Substantially higher costs for food and other consumer goods in industrial countries reflect supply chain disruptions as well as extra pricing power wielded by a consolidated corporate sector. The latter is a policy issue. The former would seem to be a one-off phenomenon, albeit complicated by a joggling sequence of disparate supply breakdowns – first, Covid tests and PPE, then toilet paper, then electronic chips for highly computerized vehicles.

Inflation and interest rates

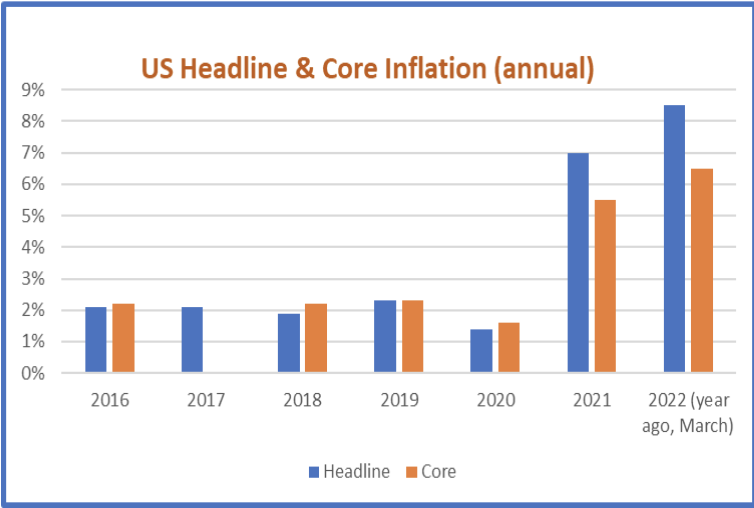

The latest U.S. inflation reading, 8.5% in March on a same-month, year-ago basis, set a 40-year high. But the opinion here is that alarmism over the issue is probably excessive. Eight percent a year inflation is unfortunate, but some commentators act as if it were eight percent a month. Crucially, data coming in now display a prominent base (or basis) effect. Interpretation must reckon with a twofold distortion in opposite directions.

A year ago, as the pandemic clobbered demand, pricing power was weak and movement of goods anemic. Today, revived demand collides with still-malfunctioning supply lines and a sometimes spotty labor market, resulting in shortages and sharp price increases. Neither set of circumstances is normal. Production, distribution and consumption will return to more predictable patterns at some point, though the timing is uncertain. The real economy, pre-pandemic, exhibited substantial problems related to equity and externalities, but no overall tendency toward runaway inflation. (Some segments, e.g. higher

education and medical care, were exceptions; let the buyer beware when purveyors ambitiously pursue the highest price the market will bear.) The intrinsic bizarreness of pandemic inflation would be an incongruous seedbed for permanent inflation. A one-off event, which still characterizes the pandemic era despite its frustratingly long duration, is ipso facto anomalous. Higher prices for products and wage increases for workers can and arguably should be absorbed, in the interest of a more robust, resilient and fair economy. Once that occurs, price changes should revert to desirably lower amplitudes, typically pegged around slightly plus or minus 2% per annum. As the chart above indicates, the U.S. economy was achieving just that during much of the past decade.

Observers with some memory can recall that possible deflation, a pattern of generally falling prices, generated a degree of anxiety not so terribly long ago. The bane of deflation is that assets lose value rather than appreciate in value, and people refrain from making purchases because they expect prices to drop. If such a scenario were to materialize, the effect would be to chill or freeze activity, eventuating in a recession or depression. Deflation is off the table for now, and that’s a good thing.

Also good, and insufficiently stressed by politicians and opinion leaders, is that economic practices and conditions historically associated with uncontrollable high inflation are generally absent at the present juncture. These are:

• Wage-price spiral – assumption that perpetually rising prices are inevitable becomes a self-fulfilling prophecy

• Bloated money supply (“the government keeps printing money”): persist at this and of course the currency will lose value

• Economic overheating – demand exceeds supply, firms chase workers and compete for supplies and equipment. This nightmare vision is standard political fodder but the real performance of the U.S. economy has seldom matched this rhetorical evocation.

• Supply side cost shock – the 1970s oil embargos offer a quintessential example. This probably comes closest to today’s inflation conundrum, but present day price increases seem more glitch-based and transitory than intrinsically scarcity-based.

Economists distinguish between so-called “headline” and “core” inflation as a rough determination whether the system is sustaining external shocks or is inherently out of kilter. The 1970s and the Covid pandemic both qualify as external shock events, a reassuring diagnosis. By implication, economic management has not failed; price conditions have only succumbed to unfortunate outside circumstances. Headline inflation captures, or attempts to capture, price changes for all goods and services consumers purchase. Core inflation excludes items with the greatest price volatility stemming from largely uncontrollable circumstances affecting production and distribution. The U.S. core inflation measure eliminates food and energy costs, allowing analysts to check whether concern for a wage-price spiral or overly loose money supply is justified.

The fact that core inflation lags headline inflation may please economists, but it doesn’t help consumers, especially low income consumers, who must suddenly peel off much more money for gasoline and groceries. The U.S. population with precarious income (and housing, and medical care) is quite large, so persistent rising prices are a serious social challenge. The time honored remedy for hazardous

inflation is to increase interest rates. Federal Reserve Chairman Jerome Powell has embarked on, and explicated, a course of tightening. Powell targets the Fed funds rate to reach 1.9% at end-2022, and 2.8% by end-2023.

Such specificity may beat inscrutability, but Powell’s neatly laid out two-year window seems too long for all to proceed according to plan. The world probability for upcoming and perhaps multiple political, military, economic, medical and climatic shocks is surely non-negligible. The benefit of some upward nudge to interest rates has drawn scarce comment, but moving a bit away from the treacherous zero lower bound adds significant, welcome maneuverability. Beyond that, a mechanical course of tightening would have to be applied in conjunction with cagey and timely monitoring of the real economy.

An economic, political, or some other form of shock is relatively likely but not an enjoyable anticipation. The shock-proneness of our limits-testing world is not a positive accomplishment.

Medium- to longer-term planning and adjustments would do well by aiming to reduce these vulnerabilities. In the meantime, however, shock risk arguably mitigates rather than aggravates the. danger of stagflation. Stagnant means no movement, nothing happening, and that certainly does not describe the world we find ourselves in.