Electrification – typically measured by population percentage with in-household access to electricity – is a paradigmatic marker for development. Sub-Saharan Africa is the world’s least electrified region, but also a current and recent hotbed for activity in the power generation sector. And some of this activity is impressively innovative (see chart). According to World Bank data, sub-Saharan inhabitants’ electricity access advanced from barely a third in 1990 to 47% by 2019. That leaves much room for further progress. The challenge is less a matter of getting the job done – residential electric power on the subcontinent will inevitably rise in availability, probably quite quickly. Rather, power projects will count as successful if they

• Enhance quality of life

• Promote diversified economic activity that offers improved opportunity on a broad, reasonably egalitarian basis

• Achieve these goals in an environmentally friendly, sustainable way.

“Leapfrog development” refers to an oft-observed phenomenon showing sectors and/or regions can

move from behind to ahead of the curve by well- timed deployment of innovations just as they attain state-of-the-art reliability. For instance, Europe and Japan rebuilt their industrial base from the rubble of

World War II, enabling them to out-compete older, increasingly obsolescent plant and equipment in the US. Africa has a chance to do the same in the power sector. The “First World” of North America, Europe and industrial East Asia has no monopoly on creativity or adaptability. Perhaps no advance deserves a more hopeful, excited appraisal than tidally generated power already on-stream in West Africa, specifically Ghana.

Tidal power plants epitomize sustainability with their direct harnessing of a recurrent natural cycle and limited number of moving parts.

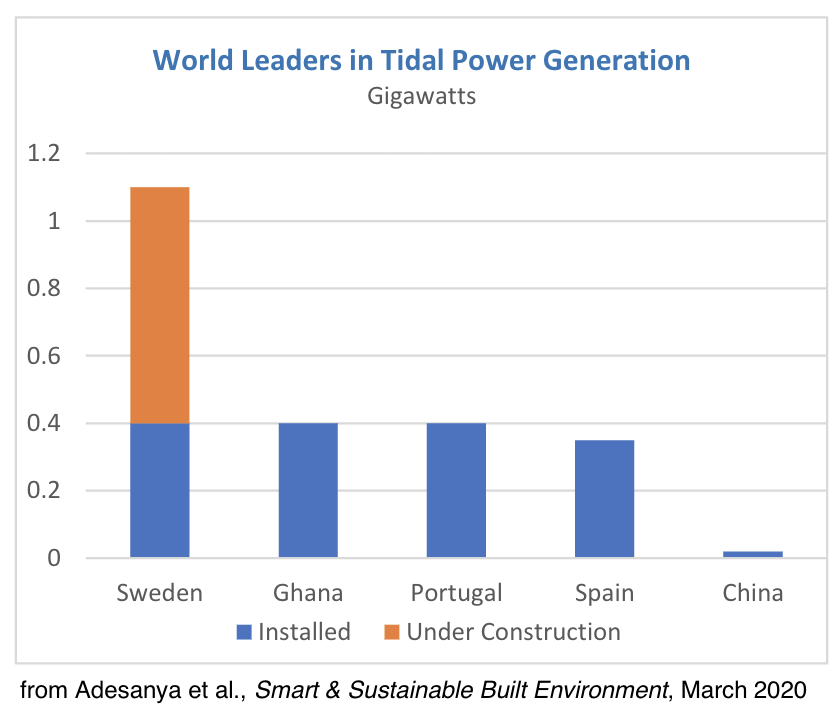

Granted, coastal West Africa’s existing capacity in this mode is only about half a gigawatt. Despite good likelihood for tidal power development at other promising sites in the region, the contribution to overall electrification from this source would only be a nice part of the total mix, not a full solution.

Yet, what’s already materialized is impressive.

Ghana ranks among world leaders in tidal

electricity generation. Its capacity in this power

subsector roughly equals both Sweden (though

Sweden is rapidly expanding this modality) and

Portugal, and slightly exceeds Spain. More amazingly, China musters barely one-

twentieth the tidal power capacity Ghana today

enjoys, notwithstanding its 8,000+ miles of

coastline, compared to Ghana’s 330 miles. This

unexpected discrepancy may not negate China’s

attribution as our century’s unstoppable behemoth, and Africa’s key development patron – but what a remarkable role reversal. Beware false fixed presumptions as to which actor displays leadership, which stays relegated to passive client status.

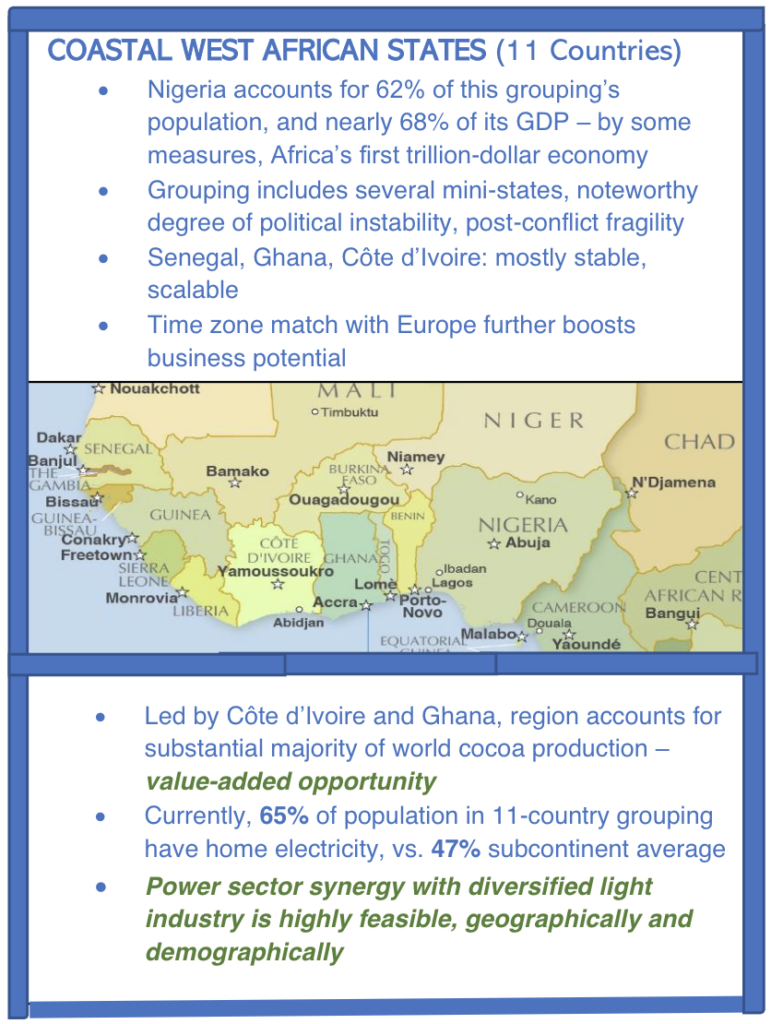

This report considers eleven nation-states in

coastal West Africa, from Senegal to the bight of

the Gulf of Guinea, shown above. (Adjoining

Sahelian states have different power resources and needs, and generally lower development.)

Demographically vibrant, the coastal region should be poised to nurture burgeoning internal and external markets that eclipse longtime primary sector/extractive industry dominance.

The future of Africa, optimistically envisioned, aligns with an old, not yet well-fulfilled anti- colonialist and postcolonial avowal:

NO MORE RESOURCE PROVINCE

How about Nigeria?

Nigeria provides a vivid case study in why so many economists, scholars, and political analysts have postulated a “resource curse.” In fact:

• Nigeria is the African continent’s first trillion dollar economy

• Its population exceeds 200 million

• Oil now represents less than a third of GDP, despite being the country’s top export by far and supplying 60% of public revenue

• In terms of area, Nigeria is close to 2½ times the size of California, with a higher percentage of usable land than California

• The jihadist Boko Haram insurgency, deadly though it is, generally spares coastal cities and southern Nigeria as a whole

• Spotty governance and unsatisfactory progress against corruption overshadow but don’t erase numerous instances of significant economic and social progress at state and local levels.

For longer than most people have been alive, Nigeria has been the subcontinent’s “sleeping giant.” To date, oil has bedeviled this country – fostering corruption, pollution, and undue government dependence on the sector for revenue. Decades (soon, a century) of failure in domestically producing refined fuel despite Nigeria’s lavish endowment of crude oil are rightfully notorious. Recent audits reveal an even deeper degree of mismanagement and corruption in the state oil company than previously suspected.

With huge money losses and public sector oil industry installations in badly decrepit condition, the idea of offloading Nigeria’s entire refinery needs to

China (a prime crude buyer) is garnering rising support. A large private sector refinery venture

appears to be floundering, as well. The informal oil sector is a frequent cause of tragedies, when

people who attempt to salvage fuel for their personal needs by tapping sabotaged or broken

pipes are killed or maimed in massive conflagrations. In oil-producing areas (Niger Delta area in the southeast), hundreds of informal refineries also operate. These basically pirate operations typically turn out 100 to 150 drums of usable quasi-gasoline daily, employing approximately 30 persons each. Lack of enough formal sector jobs probably induces some tolerance of this irregular arrangement on the part of

authorities. And yet . . . the giant shows signs of waking up, certainly in the non-oil sector. Agricultural

production is diverse and now makes up around 25% of GDP, almost as much as oil. However, increasingly unstable climate, insurgent threats, and poor infrastructure curtail agricultural gains.

Unlike other regional polities (e.g., Côte d’Ivoire, Ghana), Nigeria has made painfully slow headway in reducing poverty. Still, simply as a function of total size, this populous country’s middle class makes for a large market and growth driver. Property and retail development are transforming numerous parts of coastal and near-hinterland Nigeria. The legendary West African talent for entrepreneurship is certainly in evidence, more notably when we are talking about activities other than oil.

Another wrinkle in coastal West Africa’s potential power development synergies: Nigeria is a laggard in household electricity access across the eleven-country grouping considered here. Only 55.4% of Nigerians have home electricity. This makes the overall 11-country region’s 65% degree of access all the more remarkable, given Nigeria’s dominant 62% share of regional population.

One lesson to glean: power provision confers synergies. Whether one looks to improved mini-grids in promising parts of Nigeria, or springboards from other countries in the area whose administrative and functional problems aren’t as woolly, the demographic and geographic situation in coastal West Africa lends itself to symbiotic development of household and real-economy sectors. A “node” approach might be a helpful way to think about upcoming challenges and opportunities. Specifically, electric power developers and providers should think about:

• Connectivity between systems (the “mid-grid”)

• Harmonization of tariffs

• Easing bureaucratic obstacles to cross-border ventures linking small countries

What if Nigeria or another electrically challenged country somehow manages to reduce use of loud

and dirty diesel generators? Today, businesses of any heft and households of moderate or affluent means rely on these noxious devices for standby power amid a badly dysfunctional grid. A better grid would displace but not replace the fossil input –there are too many demands for it across the spectrum. But transformation is rarely a one-step process.

Progress, whatever form it takes, is and will be much appreciated. No panacea is at hand, but everything from old-fashioned efficiency improvements to definitively new-style tidal, wind, and/or solar installations will enhance power provision. Better electrification will, in turn, enhance possibilities for light industry. Population density and some tendency toward rising incomes create a ready-made market. As a modest baseline expectation, the region surely has the capability to attain near self-sufficiency in processed foods and a variety of consumer goods.

Closing note on Nigeria:

Projecting demand, supply, source mode, end-use Current situation: Nigeria’s installed, theoretically

operating electrical power capacity today is about 13 Tw (13 million Mw). It is mostly thermal and hydro, although the official power plan calls for 1 Tw in solar to augment the mix before the end of this decade.

Presumably, long-delayed regulatory action to curb gas flaring in oil-producing areas will foster further gas-based power development, and perhaps some interesting cogeneration projects. One should note that gas extraction is controversial when framed as a “bridge” to renewables or valid component of a desired “clean energy transition.” More gas-based power to help phase out Nigeria’s extant 5% reliance on coal as turbine feedstock seems like a winning idea. But too much growth of any fossil source has an unmistakable, increasingly urgent environmental downside. Also, the opportunity cost of investment in traditional generation modalities, if it crowds out financing for more forward-looking solutions, could be high indeed. Credible estimates of residential demand, gleaned from Nigerian and international academic, business, and policy sources, call for

• 18 Tw additional capacity

• To be developed in the short to medium term, next five to ten years, and

• Set aside for household use only

But this apparently exact appraisal of needs and intended actions becomes frustratingly indefinite against a background of regional disparities and divergent assumptions. One study set a figure of 85 Tw additional capacity needed to electrify Nigeria fully by developed country standards. No one expects this outcome by any easily foreseeable date.

NIGERIA POWER SECTOR FAST FACTS

Country has 41.2 million households, projected to reach 46 million before end of decade. Only 55% of Nigerians have household electricity. This leaves some 100 million people with zero access.

Urban areas have wide access but a substandard grid. Power cuts, need for backup generators, illegal unmetered connections are characteristic.

Power availability varies widely by region. The southwest and southeast have the best access at

65% plus, tallied as population share with residential electricity. The north fares worst, at below 40% access in many locations.

The power access divide roughly tracks the urban-rural divide. Electrification in many rural areas runs substantially below 50%.

Calculating how much power is enough depends on multiple assumptions. At present, a nonexistent “average Nigerian” (since this estimate aggregates those in electrified and non-electrified households) consumes about as much residential power in a year as the average American does in a month. Matching an “energy hog” benchmark of excessive consumption should not be the goal, but too constrained a demand projection would abrogate quality of life improvements associated with electrification.

Two key sets of variables are in play. The first set specifies which electricity-using categories and devices (appliances, lighting, cooling, electronics, etc.) count as standard, to be replicated across

households. The second set focuses on efficiency optimization. This would prioritize the most readily

attainable efficiency gains consistent with propagating benefits from home electrification as widely as possible.

Quoin Capital LLC

1515 Market St., Ste 1808

Philadelphia., PA 19102

p: 215-564 1222

www.quoincapital.com